Volatility in cryptocurrencies

The cryptocurrency market is growing very fast, but during this growth, almost all cryptocurrencies experience large fluctuations in price. This is the characteristic of an asset known on Wall Street as volatility.

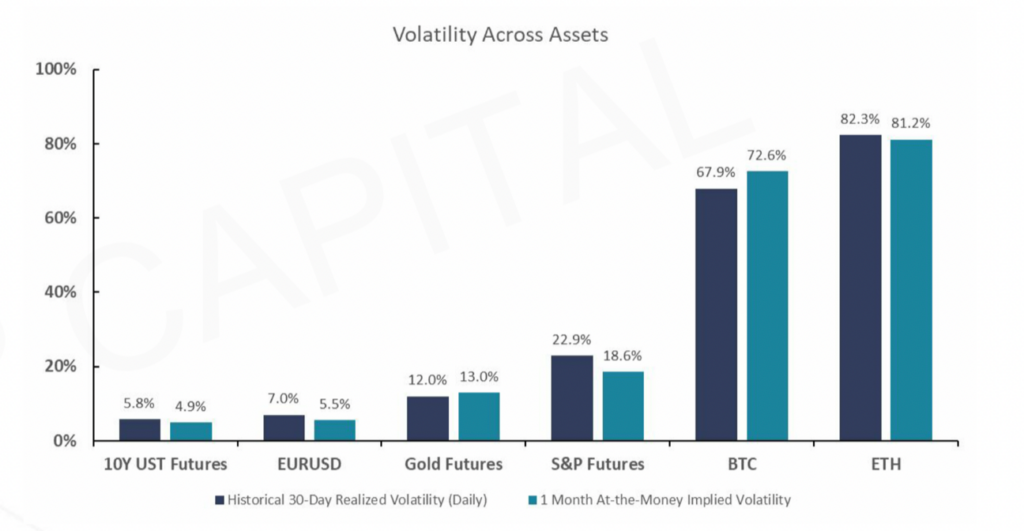

Understanding volatility is very important as it reflects the risks you bear by investing in an asset. Different people have different levels of risk tolerance and this affects their choice of asset class. On the chart, you can see a comparison of the volatility of cryptocurrencies and other assets.

Realized volatility is an assessment of the change in an asset by analyzing its volatility over a period of time. In statistics, the most common measure of volatility is the measurement of the standard deviation, i.e. the variability from the mean. This is a measure of actual price risk.

In simple terms, volatility measures how much the price of an asset fluctuates on a given day.

Why is the cryptocurrency market so volatile?

The cryptocurrency market is quite young and a priori it will be much more volatile than the mature and time-tested traditional one. The crypto market has much less liquidity and trading volume, and this also affects volatility.

Most often, the market capitalization of crypto assets is not as large as that of traditional assets. Generally, the smaller the market capitalization of an asset, the more volatile it is. Imagine that you are throwing a rock into a small pond. Now take that same stone and throw it into the ocean. The stone will have a much greater impact on the pond than on the ocean.

Today, the market capitalization of bitcoin is about $670 billion. In comparison, the market capitalization of gold is about $3 trillion. In simple terms, a higher price equals a higher market cap, and a higher market cap equals lower volatility.

You can protect yourself from volatility in cryptocurrencies using option strategies. Moreover, options allow you to bet on the rise or fall of volatility. You should also stop using borrowed funds in assets with high volatility.

Conclusion

More and more institutional investors come to the cryptocurrency market and they reduce the volatility of coins by investing in large volumes. Despite this, cryptocurrencies are still considered to be an extremely volatile asset. A price change of 10-15% in one day is not uncommon.

The high volatility of cryptocurrencies makes it difficult to use them as a means of payment, and also makes them too risky for conservative investors. On the other hand, high volatility means that investors can make good profits from trading. As the cryptocurrency market matures, its volatility will decrease accordingly.