Ventures Index: overview of two projects

Let’s continue our review of projects from Venture Index

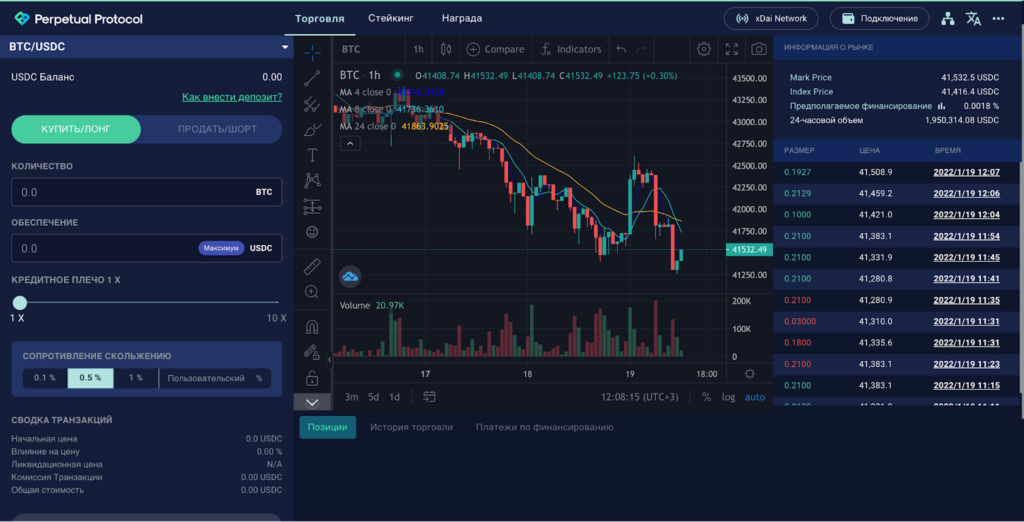

The first project: Perpetual Protocol

What is it?

Perpetual Protocol is a decentralized exchange (DEX) for Ethereum and xDai futures. Traders are able to open long or short positions with up to 10X leverage for a growing number of assets such as BTC, ETH, DOT, SNX, YFI and others. Traders always retain ownership of their net assets. Perpetual Protocol uses a Virtual Automated Market Maker (vAMM) that provides liquidity to the network with predictable pricing set by constant product curves. In addition, Perpetual Protocol has designed its vAMMs to be market neutral and fully collateralized.

The stated vision of Perpetual Protocol

Perpetual Protocol’s stated vision is to create the world’s best, most accessible and most secure decentralized derivatives trading platform, building on DeFi projects and allowing projects to create Perpetual Protocol. After reaching a number of milestones in its roadmap, such as launching betting pools and implementing limit and stop orders, Perpetual Protocol plans to expand to other networks, introduce leveraged tokens and launch dynamic liquidity in its pools.

The goal of Perpetual Protocol

Perpetual Protocol’s goal is to create a platform for trading perpetual contracts that anyone can use. To do this, users must be able to trade with good liquidity and low slippage. Perpetual Protocol solves this problem with its vAMM solution. Perpetual Protocol does not follow the usual order book model of centralized exchanges. Instead, traders trade against a virtually automated market maker whose initial liquidity is set by the operator.

Using this vAMM model and creating an exchange on xDai, traders can enjoy net trading without commissions and instant settlement. In addition, Perpetual Protocol supports gas-free deposits over $500, which means traders can make deposits with 0 ETH in their wallets.

In October 2021, PERP reached a price of $21, as of January 19, 2022, it is trading at $8.9

This project is promising, the growth of derivatives on the crypto market is considered one of the trends in 2022-2023

The second project: MIR token

What is it?

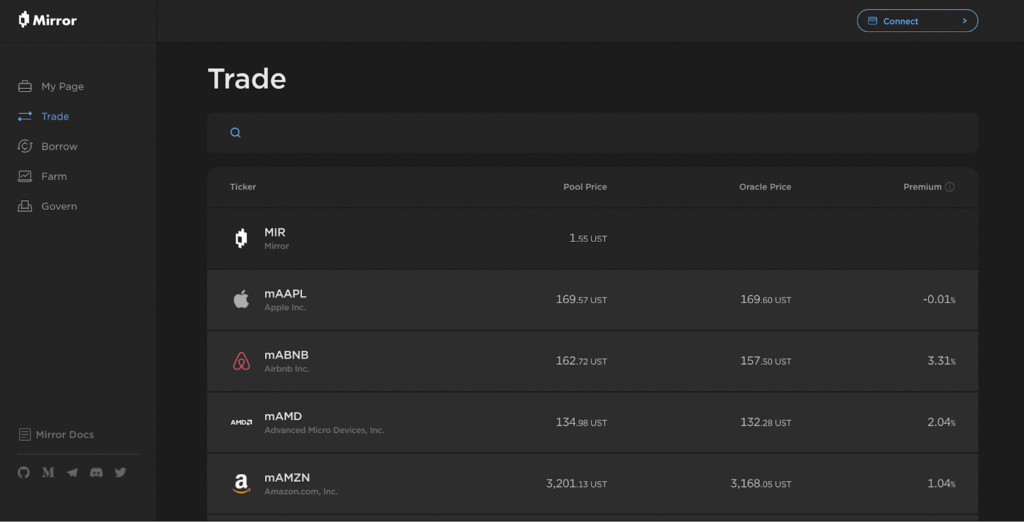

MIR is a Mirror Protocol control token, a synthetic asset protocol created by Terraform Labs (TFL) on the Terra blockchain.

The Mirror Protocol has been decentralized since day one, and treasury on the network and code changes are regulated by the holders of the MIR token.

The goal of MIR

The goal is a fully decentralized, community-driven project.

What are Mirror assets?

Mirror assets are blockchain tokens that behave like “mirror” versions of real assets, reflecting exchange prices on the network. They give traders access to the prices of real assets while providing equity ownership, open access, and protection from censorship, just like any other cryptocurrency. Unlike traditional tokens, which serve to represent the real underlying asset, mAssets are purely synthetic and only capture the price movement of the corresponding asset.

Advantages of the Mirror assets

- Global accessibility: in most markets outside Europe and North America, access to foreign stocks and forex markets is severely limited.MIR provides global accessibility with no entry barriers.

- Fractional Orders: In traditional finance, to execute a fractional order, multiple fractional orders are combined to execute a single transaction. The process of assembling all orders into one requires additional wait time. With blockchain, order volume is simply presented as a number on the blockchain, so there is no need for an intermediary aggregation process.

- Almost instant order execution: often due to lack of liquidity (order book algorithm with price and time priority) full order execution can take up to days. Given the fact that Mirror relies on liquidity provided by each individual asset pool, orders can execute as fast as the network lock-up time (~6 seconds).

Over the last year, Mirror token has seen its biggest drop from $12 to $1.55.

We suppose that this price level is quite attractive for long-term investments