New DAO Index of ECOS

What is DAO?

DAO is an organization without central management. It is a virtual organization in which decision-making and financial management are managed using blockchain technology.

What was the idea behind it?

The idea was first introduced by Dan Larimer in 2013 when he described cryptocurrency as the stock of a decentralized autonomous corporation, which is an organization whose rules are determined by the source code.

According to the DeepDAO service, DAOs grew with incredible strength last year, exceeding 1.6 million members in December, 130 times more than just 13,000 members in January of last year.

A DAO, as an organization based on the Internet and blockchain, offers several advantages over a traditional business.

What are the advantages?

Unlike a formal organization, where trust is the primary motive for bringing people together, a DAO has parties who trust the community charter. The code that manages the smart contract controls every task necessary for the organization to function.

Here are some of the key characteristics of DAO that set it apart from any traditional organization:

- A core group of the community came up with the concept and charter;

- Any DAO member can easily review any financial aspect of the firm, making it publicly available for audit;

- Voting on code or protocol changes should be transparent;

- DeFi, NFT, and utilitarian use cases can be built into the system.

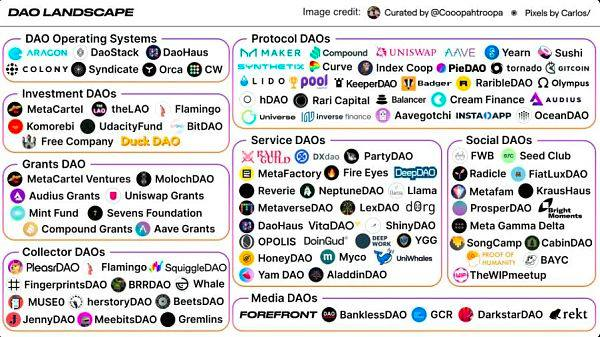

Categories DAO can fall into, depending on its structure, methods of operation, and technology:

Operating Systems – Standalone platforms that allow organizations to create their own DAOs. Key projects include Orca and Colony.

Protocol DAOs – Shared DAOs are decentralized, autonomous organizations that use tokens as voting metrics to implement the protocol and financial changes. Key projects include Uniswap, Maker, Yearn, Synthetic, Curve and others.

Investment DAOs – supports capital pooling for various DeFi transactions and investments. Key projects include The LAO, BitDAO and others.

Collection DAOs – designed for NFTs and artists to support partial or full ownership of art and content. Key projects include Flamingo.

Grants DAOs – more like decentralized venture capitalists with communities where management tokens are used to vote on capital allocation. Key projects include Audius Grants, MolochDAO and others.

Social DAOs – a decentralized platform for interaction, e.g. on social networks. Key projects include Seed Club, FWB and others.

Below you can see the top 10 DAO projects

According to DeepDAO, DAO is already a significant market, with a market valuation of about $13 billion. Uniswap (UNI) leads the ecosystem with over 2,75,000 members. BitDAO ecosystem tokens lead the treasury

DAO, as a concept and even technology, can change the way business works. Digital autonomous organizations have a bright future ahead of them if people take the time to learn the ins and outs of the concept. To summarize everything we’ve discussed, a DAO can be anything

from a channel to a social networking platform to a trading platform (Automated Market Makers) and everything in between. It’s just a representation of a contrived physical concept turned into a large-scale decentralized enterprise.

DAO is already acknowledged as a trend for 2022-2023 in the cryptocurrency market, and we created a new investment portfolio that responds to these DAO index trends.

It includes the following promising projects:

- Synthetix

- Meric Circle

- Yield Guild Games

- Tornado Cash

- SushiSwap

In the following articles, we will tell you in detail about each of the projects